We advance financial inclusion by ensuring individuals and businesses have access to the necessary financial products, resources, and education to help meet their diverse needs.

We believe that financial education and opportunity can lift up people of all backgrounds, all around the world. Together with Principal® Foundation we’re working to reach them with the information and resources that resonate.

In 2021, together with Principal Foundation,

In 2023, we achieved our five-year goal in our third year with a total of 14,745 diverse entrepreneurs and businesses supported.

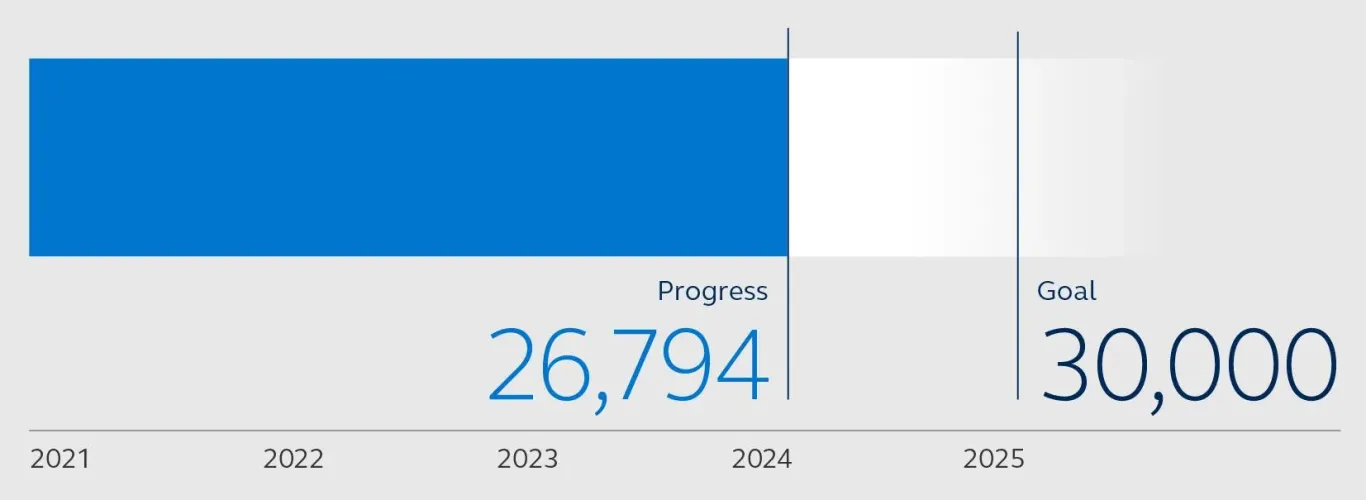

We are excited to have reached this milestone before our goal date, but remain steadfast in our commitment to advancing our support for this business community. Therefore, we have updated our goal to triple the number of diverse SMBs we support by 2025, an increase of 30,000 diverse SMBs from our 2020 baseline.

- Product access: making insurance and savings products more accessible to diverse business owners.

- Community development: providing insights, education, and support for diverse SMBs to tackle common obstacles and act on issues important to them.

- Capital access: advocating for more equitable access to capital for diverse businesses and entrepreneurs.

- Financial education: supplying financial education that empowers diverse SMBs to make informed financial decisions, manage risks, and position their businesses for long-term success and sustainability.

Clear and consistent measures of progress matter in financial inclusion. This means using data-driven insights to understand the barriers to financial security and setting goals and establishing accountability to address gaps. We partner with the Centre for Economics and Business Research (Cebr) to release the Global Financial Inclusion Index (Index). The Index ranks 41 markets on three clearly defined pillars of financial inclusion: government support, financial system support, and employer support.

Learn more: The Global Financial Inclusion Index

2024 highlights:

- Supported 12,049 diverse entrepreneurs and SMBs

- 6.6% of SMBs owned by women

- 3.2% of SMBs owned by people of color

Principal Foundation is committed to removing barriers, creating opportunities, and empowering more people to build financially secure futures. Principal Foundation is a duly recognized 501(c)(3) non-profit entity focused on providing philanthropic support to programs that build financial security in the communities where Principal Financial Group, Inc. (“Principal”) operates. While Principal Foundation receives funding from Principal, Principal Foundation is a distinct, independent, charitable entity.

Our grantmaking supports organizations whose work focuses on building people’s wherewithal to pursue financial security and expands access to the resources they need to reach their goals. Specifically, our funding champions programs that address essential needs and promote financial enablement of individuals and small businesses.

2024 highlight:

- Principal Foundation provided more than $18.8 million to our communities around the globe

Encouraging Principal employees to bring their passions and purpose to work is the core of the Principal For Good program, which connects them to our philanthropic culture through volunteer opportunities and incentives and a match giving program. The program draws on the expertise and resources of the business to strengthen communities and create lasting impact in the cities where our employees live and work.

2024 highlights:

- 95,616 volunteer hours logged by eligible users

- $6.2 million matching dollars given to eligible organizations by Principal Foundation

2024 Sustainability report

Read more about our commitment to sustainability.

Download full report (PDF)